Excel File: Value Stocks with 6 Different Valuation Methods

🎯📈 Master the Stock Market 🚀🌟

2024 is going to be a great year for the Indian stock market – the 🇮🇳 Indian elections , US rate cuts, and a robust economy. 📊 Utilize this sheet to demystify company analysis with our versatile 6 in 1 Value Investing Excel File. ☕ For less than the price of a Starbucks coffee, enjoy the freedom to assess the value of all Indian companies, indefinitely. 💸 No hidden charges.

Watch Explainer Video

Screener Just Gives You Stock Data. We Give You the Answers.

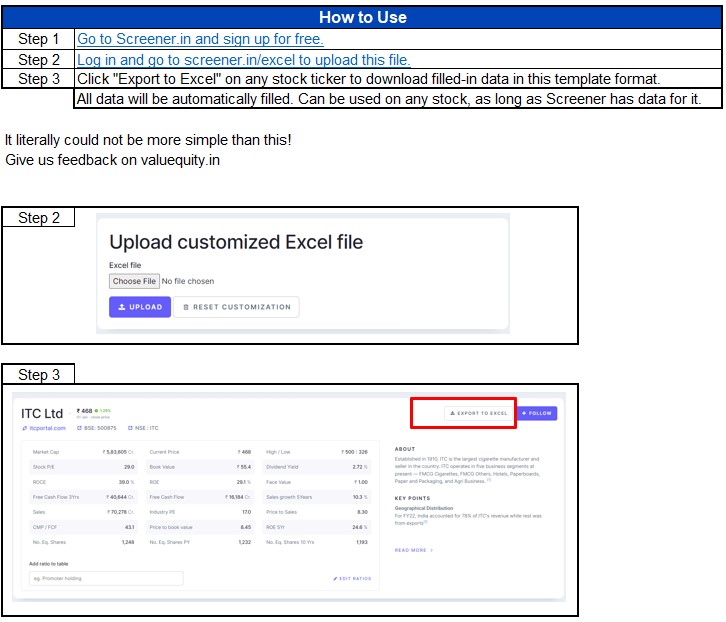

We follow value investors like Warren Buffet, Mohnish Pabrai and Ben Graham to give you 6 rock-solid valuation methodologies in 1 Excel sheet. Simply upload to Screener.in, and download the data for any stock at any time. You now have all the valuations. It’s literally 3 just clicks.

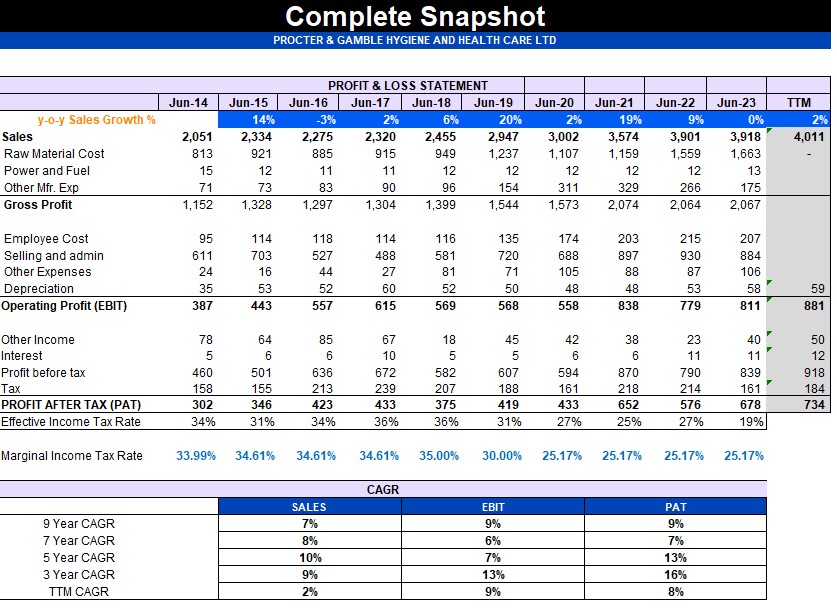

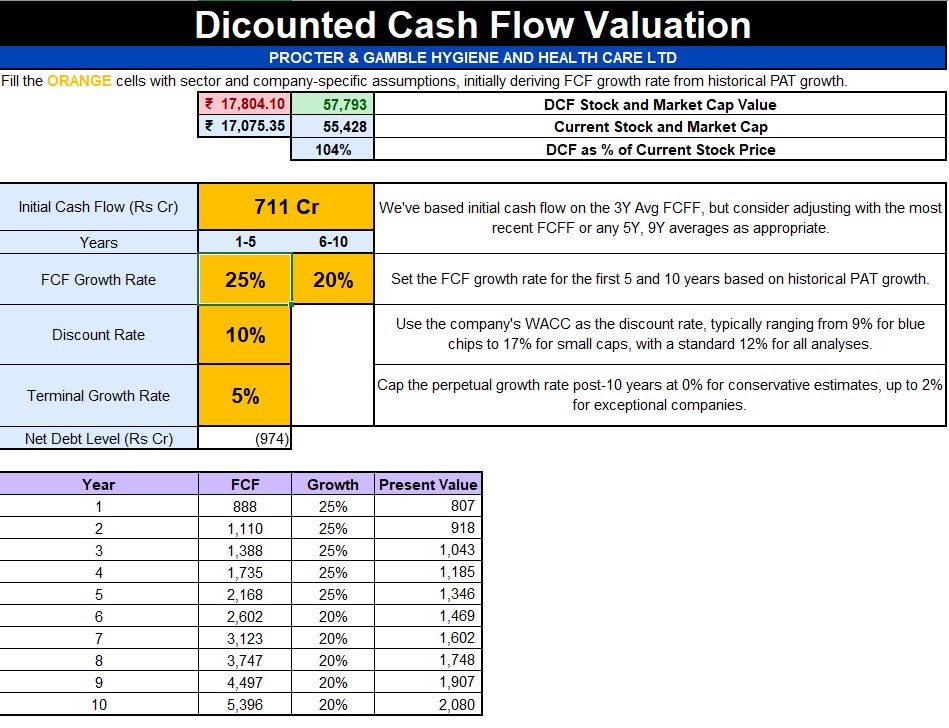

Discounted Cash Flow Method

Calculates a company’s value by projecting its future cash flows and discounting them to present value using the required rate of return.

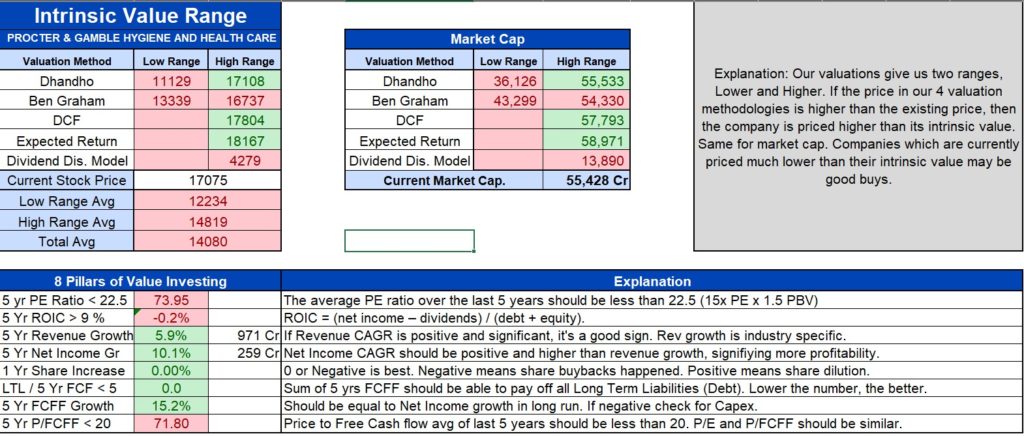

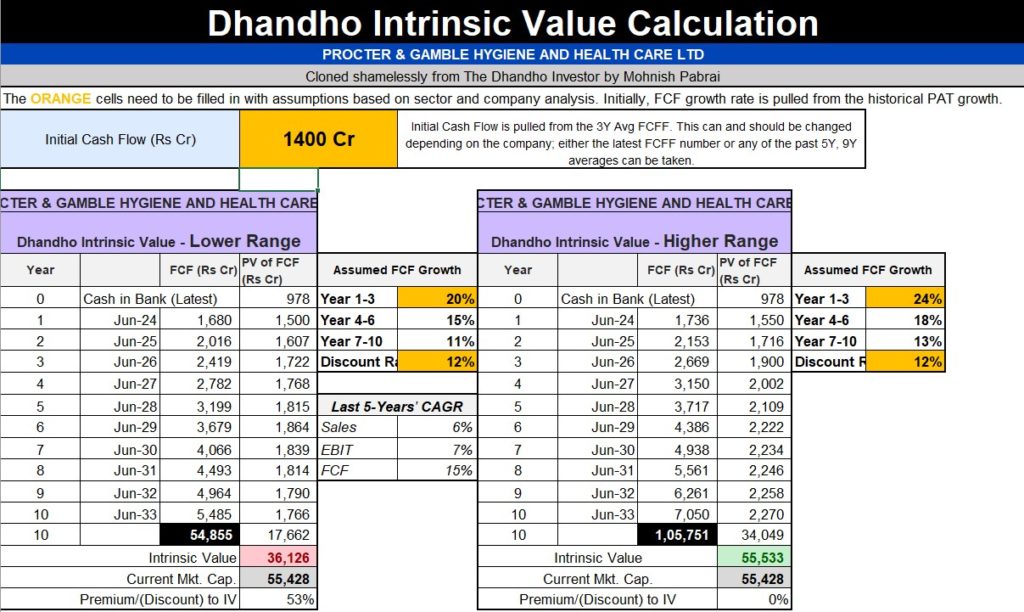

Dhando Investor Method

Focuses on investing in businesses available at a price significantly lower than their intrinsic values, with an emphasis on minimizing risk.

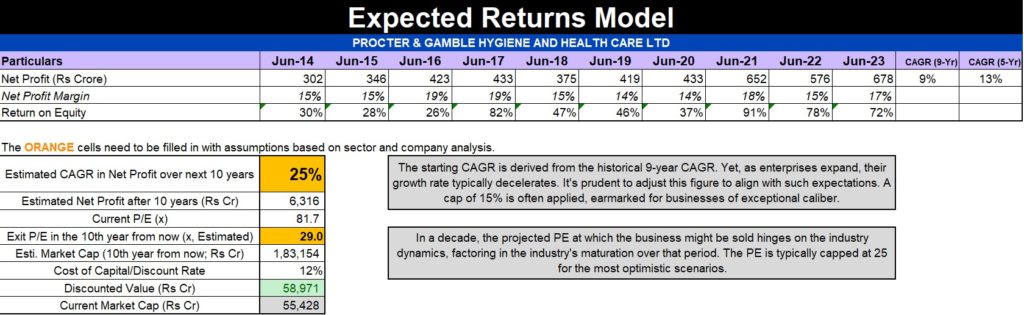

Expected Value Method

Determines the weighted average of all possible values, based on the probabilities of different outcomes, often used for uncertain investment scenarios.

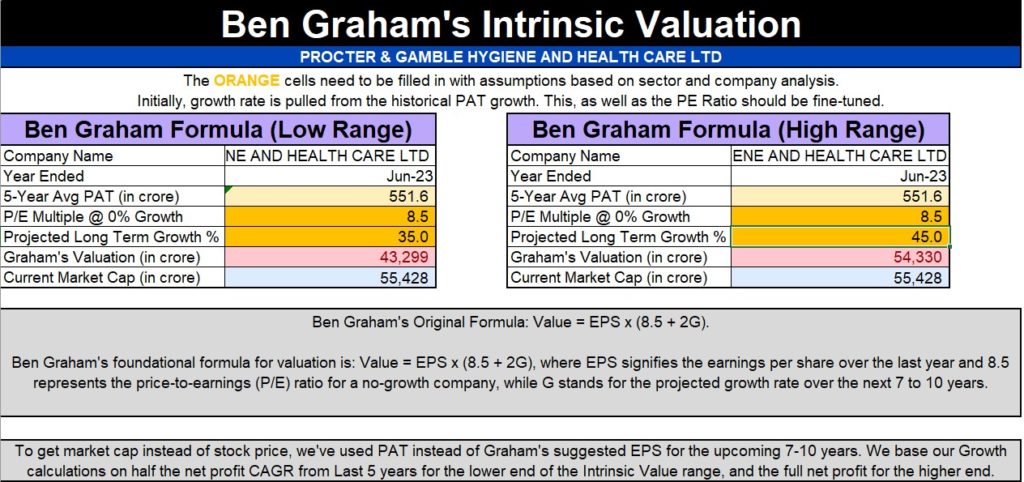

Ben Graham Valuation Method

Assesses a stock’s intrinsic value using earnings and book value to identify undervalued companies with a margin of safety.

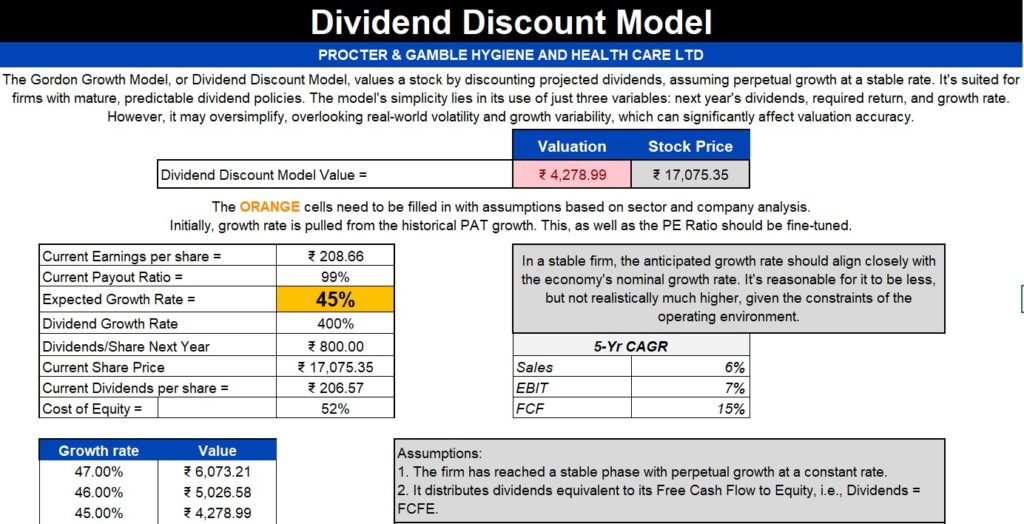

Dividend Discount Model

Values a stock based on the present value of future dividends, suitable for companies with predictable dividend payouts.

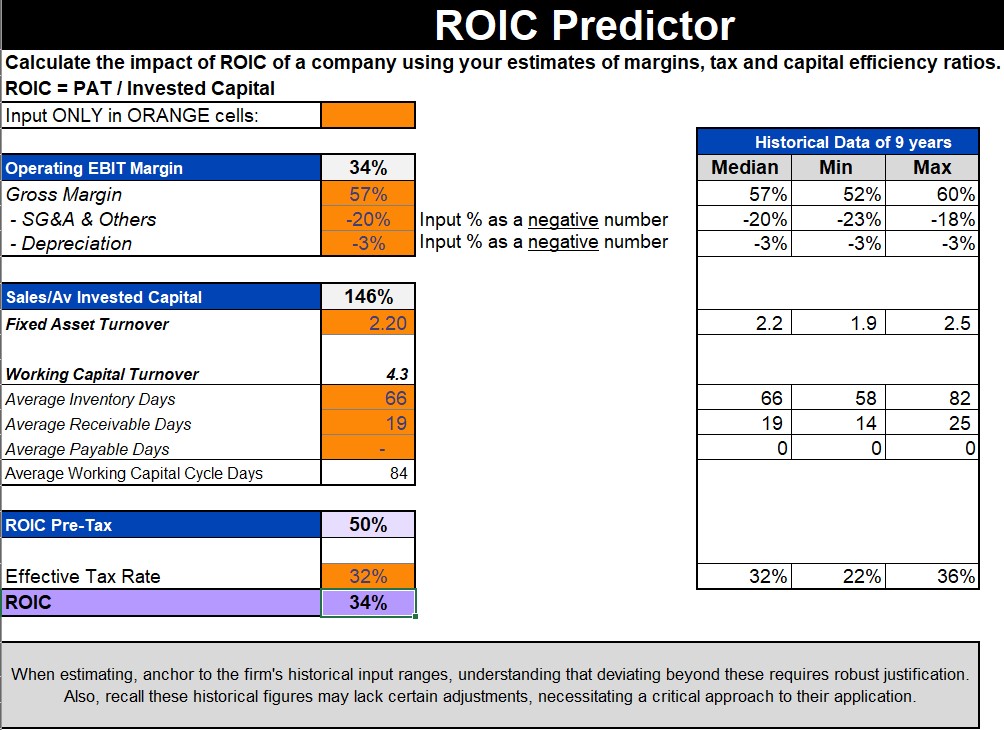

ROIC Predictor

Evaluates a company’s efficiency at allocating capital under its control to profitable investments by measuring return on invested capital.

Why Use This Sheet?

There’s a lot of data out there. 📊 How can you use it to value your stocks? 📈 We created a simple sheet with valuation methodologies used by value investors 🧮 from IIMs, IITs, Investment Banking & MBB Consulting backgrounds. 💼📋

Simplify the Financial Jargon

No need to worry about calculating WACC, ROIC, FCFE or any other metric. The sheet is pre-filled to give you one-click valuations, but you can adjust it individually.

Infinitely Reusable Excel File

The basics never change. Once you have the sheet, it’s all yours; use it infinite times for any stock, any time.

Built by Credible Investors from IIM, IIT and MBB

The model is built from years of personal use by several IIM grads, who came together to build this and share with Bharat.

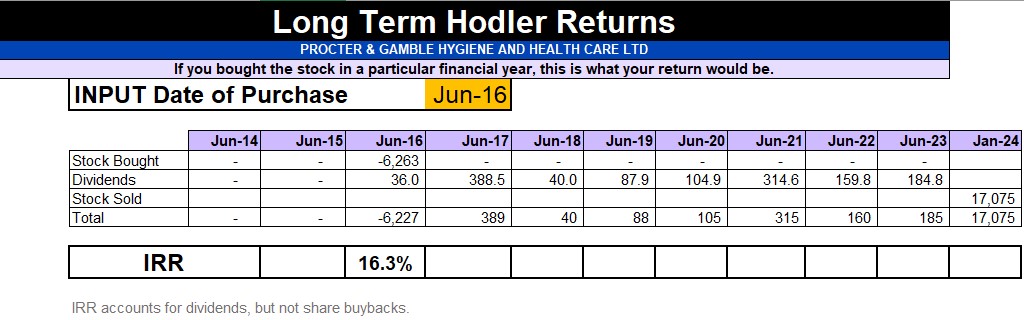

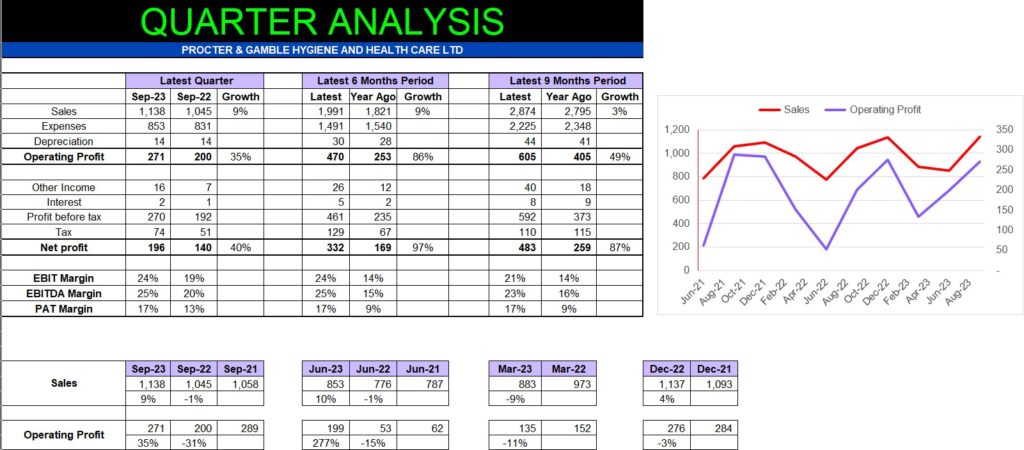

What else do you get?

Aside from 6 valuation methodologies, you also get the following in the Excel file (and much more!)

Screenshots

Do you have any questions? Reach out to us and we’ll help you out!

How to Use ValuEquity Excel File

It takes literally 2 minutes, and 3 clicks.

Folks Who Used the Sheet Say

Rohan Mehta

Financial Analyst, Stealth Startup

With ValueQuity’s Excel sheet, I’ve finally cracked my stock analysis code. It’s soo in-depth but literally takes a few clicks to evaluate potential stocks without sacrificing my busy schedule. My portfolio is healthier thanks to this tool.

Priyanka Singh

Senior IT Consultant, Pune

As someone with little time to analyze stocks deeply, ValueQuity’s sheet has been a game-changer. Bharat desparately needed something that was equivalent to the numerous US-based tools, and this sheet is it.

Rahul T. Jain

Marketing Manager, Amazon Web Services

I’m not a financial expert, but ValueQuity’s Excel sheet made me feel like one. The simplicity of the Dhandho Investor Method allowed me to invest confidently, and I’ve seen a positive impact on my investments. It’s efficient and user-friendly.

limited time

70% Off